Step-By-Step Guide: How To Buy Treasury Bills And Bonds In Uganda

Make Your Money Work for You

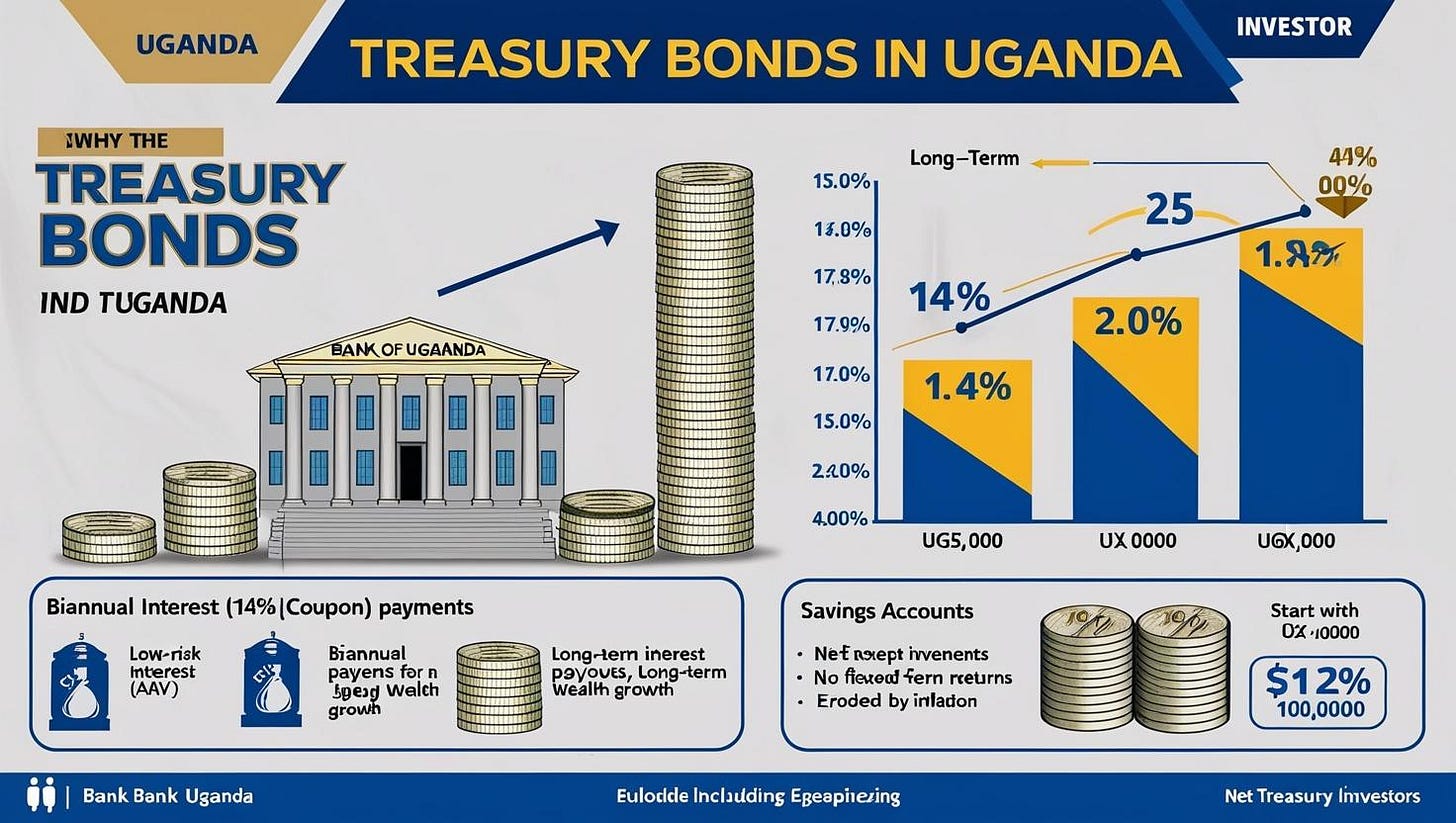

Imagine this, you’ve been saving money for years, but each time you check your savings account, the interest earned barely covers inflation. Frustrating, right? Uganda’s inflation rate fluctuates, often hovering between 3% and 6%. Inflation Rate in Uganda averaged 5.75 percent from 1998 until 2024, reaching an all time high of 24.40 percent in November of 2011 and a record low of -5.36 percent in November of 2001 as per Uganda Bureau of Statistics (UBOS). Meanwhile, most savings accounts offer interest rates as low as 2% to 4%. This means that while your money sits in the bank, its purchasing power is shrinking. You may feel like you're saving, but in reality, you're losing value over time.

Now, picture an alternative: investing your money in a safe and secure option where your returns outpace inflation, ensuring your wealth actually grows. Sounds better? That’s exactly what Treasury Bills (T-Bills) and Treasury Bonds (T-Bonds) offer.

Many Ugandans shy away from investing in government securities because they think it’s complicated or requires millions of shillings. The truth? You can start with just UGX 100,000 and enjoy better returns than most savings accounts offer. This guide will walk you through how to invest in Treasury Bills and Bonds step by step, from setting up your account to receiving your first payout. Let’s dive in!

1. Understanding Treasury Bills and Bonds

Before investing, it’s crucial to know what you’re putting your money into.

Treasury Bills (T-Bills) are short-term investments that mature in 91 days (3 months), 182 days (6 months), or 364 days (1 year). They are sold at a discount, meaning you pay less than their full value and receive the full amount when they mature. The difference is your profit.

Treasury Bonds (T-Bonds) are long-term investments that mature in 2, 3, 5, 10, 15, or 20 years and pay interest (called coupons) every 6 months until maturity. At the end of the term, you receive your original investment back.

Now that you understand these investment options, let’s move on to what you need to get started.

2. Requirements for Investing in Treasury Bills and Bonds

Before you start, make sure you have the following:

✅ A bank account with a commercial bank in Uganda

✅ A valid national ID or passport

✅ A Central Securities Depository (CSD) account (more on this in the next step)

✅ At least UGX 100,000 (the minimum investment amount)

With these in place, you’re ready to open your investment account.

3. Step 1: Open a Central Securities Depository (CSD) Account

Think of a CSD account as your investment wallet—it holds your Treasury Bills and Bonds just like a bank account holds your money. You cannot buy Treasury securities without one.

How to Open a CSD Account:

· Visit a commercial bank that participates in government securities (most major banks do).

· Fill out a CSD account opening form with your personal details.

· Provide a copy of your national ID or passport.

· Your bank will process your request, and within a few days, your CSD account will be ready.

· Once opened, you’ll receive a CSD account number—this is your key to investing.

Now, you’re ready to buy your first Treasury Bill or Bond.

4. Step 2: Choose Between Treasury Bills and Bonds

Before investing, decide whether you want short-term (T-Bills) or long-term (T-Bonds) investments. Ask yourself:

Do I want quick returns in less than a year? → Choose T-Bills

Do I want steady, long-term income? → Choose T-Bonds

Can I wait for bigger profits over time? → Choose longer-term T-Bonds

If you’re unsure, start with a small investment in T-Bills to get familiar with the process before committing to T-Bonds.

5. Step 3: Participate in the Auction Process

The Bank of Uganda (BoU) sells Treasury Bills and Bonds through auctions, usually twice a month for T-Bills and once a month for T-Bonds. Here’s how you can take part:

Your commercial bank will notify you of upcoming auctions.

You submit a bid indicating how much you want to invest.

The Bank of Uganda reviews bids and determines the interest rate.

If your bid is accepted, you receive a confirmation from your bank.

You transfer the money to BoU through your bank.

You receive an official confirmation of your investment.

6. Step 4: Making Payments and Receiving Confirmation

If your bid is successful, your bank will inform you of the amount to be paid.

You must transfer the funds within the specified time to secure your investment.

Once payment is confirmed, your Treasury security is credited to your CSD account.

Now, you officially own a piece of Uganda’s debt—congratulations!

7. Step 5: Managing Your Investment

For T-Bills, you’ll receive the full value at maturity. For T-Bonds, you’ll receive interest payments every 6 months until the bond matures. These payments go directly to your bank account.

Want to reinvest? Use your earnings to buy more Treasury securities and enjoy the power of compound interest.

8. Step 6: Selling Before Maturity (Optional)

Life happens. If you ever need to access your money before your bond matures, you can sell it in the Secondary Market through your bank. The process is quick, and you usually get your money within 24 hours. However, the selling price may depend on market conditions.

Final Thoughts: The Best Time to Start is NOW!

Investing in Treasury Bills and Bonds is a low-risk, high-reward way to grow your money over time. Whether you're saving for a home, your child’s education, or retirement, government securities provide a safe and stable way to build wealth. The best part? You don’t need millions to start. With just UGX 100,000, you can take the first step towards financial freedom.

So, what are you waiting for? Open your CSD account today and start investing!

Author:

Charles Jubilee Eibu

Civil Engineer

“A passionate young investor dedicated to promoting economic development and social well-being among youth."